SASSA Pension Increase 2026: What Elderly South Africans Need to Know The SASSA pension increase planned for 2026 matters greatly to over a million elderly South Africans who rely completely on this grant for their everyday needs. As living costs continue to rise steadily these yearly adjustments provide essential support that helps maintain basic living standards & reduces the financial pressure that many seniors experience. The South African Social Security Agency manages the older persons grant as part of the country’s social welfare system. This monthly payment supports citizens who have reached the qualifying age & meet the required criteria. The government reviews and adjusts these grants annually to account for inflation and changing economic conditions.

Why the 2026 SASSA Pension Increase Is So Important

For many senior citizens in South Africa, the Old-Age Pension grant is their primary source of income. In most cases, this amount remains below what elderly individuals require to meet daily living needs in 2026. The 2026 pension increase aims to reduce financial strain caused by rising food prices, higher transport costs, increasing healthcare expenses, and growing utility bills. Even a modest adjustment can make a meaningful difference, helping pensioners cover essential costs while offering a greater sense of financial stability and security.

Who Is Eligible for the 2026 Pension Increase

The 2026 pension adjustment applies to individuals who receive the Old Age Grant from SASSA. To qualify, applicants must be 60 years or older and meet the required income and asset thresholds. The increase benefits both existing beneficiaries and new qualifying applicants. Those receiving War Veterans grants or similar approved support payments are also included, ensuring that eligible seniors continue to receive assistance aligned with their needs.

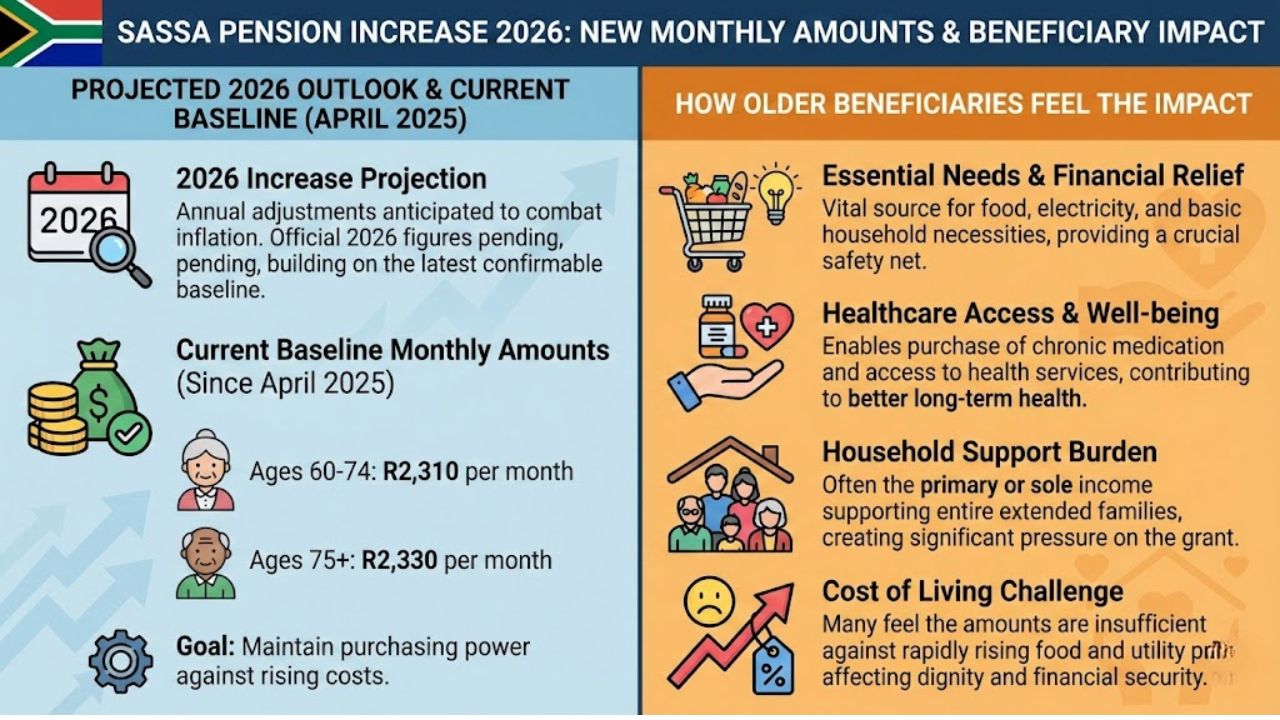

Updated Pension Amounts Explained in Detail

In 2026, pension payments were reassessed and adjusted to reflect inflation trends and prevailing economic conditions. This revaluation was introduced to help close the growing gap between rising living expenses and the fixed incomes that retirees rely on. By aligning pension values with current cost pressures, the update aims to provide seniors with better financial support while maintaining the original structure of the grant system.

Pension Payment Schedule and Ways to Access Funds

SASSA operates on a structured payment timetable to ensure pensioners receive their funds consistently and on time. Payments can be accessed through bank accounts, SASSA cards, ATMs, and approved retail outlets. Beneficiaries are encouraged to check payment dates in advance and plan their monthly expenses accordingly to avoid unnecessary financial pressure.

Key Details Pensioners Should Always Remember

Pension recipients must keep their personal information and banking details updated to prevent payment disruptions. Any changes in income, address, or eligibility status should be reported to SASSA immediately. Accurate and current records help ensure that pension payments continue smoothly without delays or interruptions.

How the Pension Increase Supports Better Living for Seniors

The 2026 pension increase offers more than just additional income. It strengthens financial security and helps older adults maintain their independence while managing essential healthcare and housing needs. Improved pension support allows seniors to contribute to family responsibilities, handle everyday expenses with less stress, and remain more economically active within their communities.

Final Summary of the 2026 SASSA Pension Updates

The 2026 SASSA pension increase plays a vital role in helping elderly citizens manage ongoing financial challenges. By understanding eligibility criteria, payment schedules, and grant conditions, pensioners can plan their finances more effectively and feel more secure throughout the year. This support exists to assist retirees during difficult economic periods, and knowing how the system works enables smarter budgeting and better financial decisions.