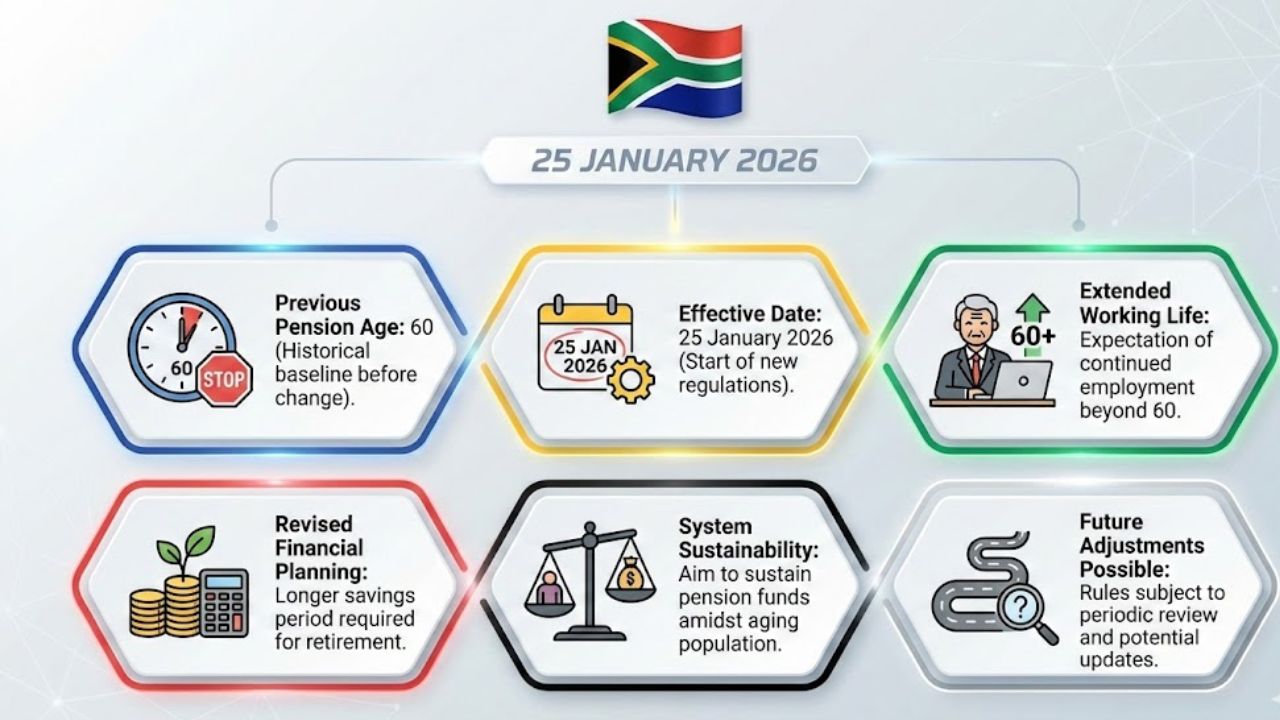

South Africa is getting ready for a big change in retirement rules that will start on 25 January 2026. For many years most workers retired at 60 but things are changing. People are living longer & the economy is under pressure so the government decided it was time to update the old system. The new retirement framework will work differently for government workers and private sector employees and will affect how people plan their pensions & savings for the future.

South Africa Introduces Higher Retirement Age Under Updated Pension Policy

South Africa’s revised pension rules signal a clear shift away from the long-standing retirement benchmark of 60. Under the updated structure, workers may need to remain economically active for a longer period, depending on their employment sector and pension fund regulations. This change is driven by longer life expectancy, increasing pension expenses, sustainability goals, and the need for continued workforce participation. Authorities state that extending working years supports pension stability while giving individuals more time to strengthen their retirement savings. However, for many employees, particularly those in physically demanding roles, the transition raises concerns around health, job security, and income reliability later in life.

What the Revised Pension Age Means for South African Employees

For workers across South Africa, the new retirement age brings practical implications beyond a fixed number. Employment contracts, retirement fund rules, and employer agreements will now play a greater role in determining retirement eligibility. Key factors include sector-specific conditions, pension fund terms, early retirement penalties, and longer contribution periods. While some employees may benefit from extended earning years and potentially higher payouts, others are concerned about delayed access to pension income. Financial advisors are urging workers to review their plans early to avoid unexpected income gaps during the transition.

Impact of the New Retirement Rules on Pension Planning

The move toward a higher retirement age places increased importance on forward-looking pension planning in South Africa. Individuals nearing their late 50s are being encouraged to reassess savings strategies and adjust projected retirement timelines. Planning considerations now include revised savings targets, extended working years, healthcare cost preparation, and income bridging options. Employers and pension funds are also expected to provide clearer guidance to members. While the reform is designed to strengthen long-term pension sustainability, its effectiveness will depend on how well workers adapt and the level of support provided throughout the change.

Key Takeaways and Real-World Effects

The gradual end of guaranteed retirement at 60 represents a major cultural and financial shift in South Africa. These updated rules aim to align pension systems with modern economic realities while placing greater responsibility on individuals to plan ahead. Important takeaways include later retirement expectations, increased personal planning responsibility, policy-driven adjustments, and a focus on long-term financial resilience. For workers, staying informed and seeking professional guidance will be essential to navigating the evolving pension landscape with confidence.

| Category | Before 2026 | From 25 January 2026 |

|---|---|---|

| Standard Retirement Age | 60 years | Above 60 years (sector-wise variation) |

| Pension Eligibility | Available at retirement | Aligned with revised age criteria |

| Contribution Duration | Relatively shorter period | Extended contribution requirement |

| Early Retirement Option | Widely permitted | Subject to tighter conditions |

| Retirement Planning Complexity | Moderate planning needed | Higher planning and compliance required |