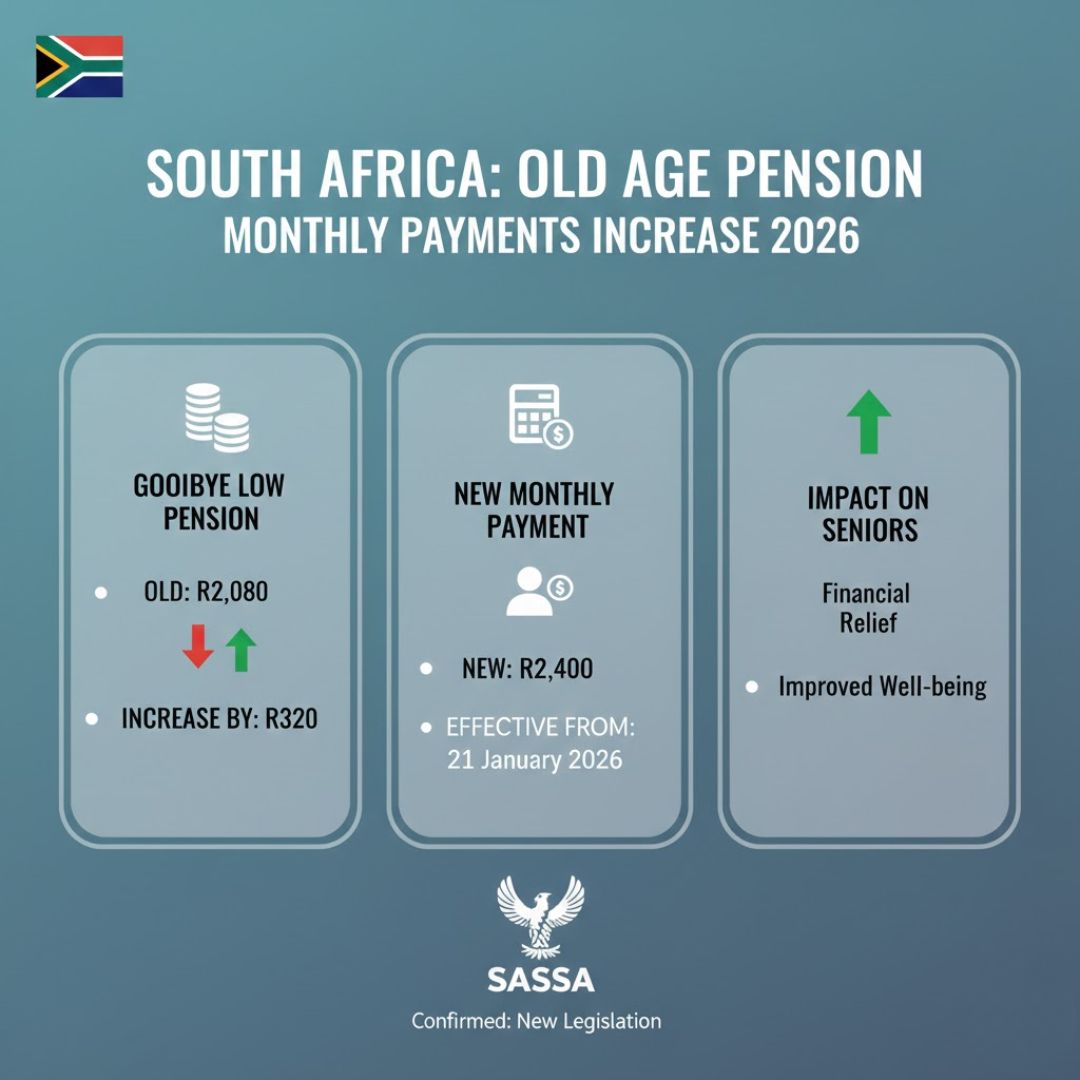

South Africa’s old age pension system is entering a new phase as monthly payments for seniors rise to as much as R2,400 from 25 January 2026. This adjustment marks a notable shift in how the country supports older citizens facing higher living costs, rising medical expenses, and ongoing economic pressure. For many households, the old age pension is the main source of income, making this change especially significant. The updated payment levels aim to improve stability, restore dignity, and help seniors better manage daily expenses in the year ahead.

Old age pension increase brings higher monthly support

The latest adjustment signals a clear move away from historically low payouts, with many beneficiaries now qualifying for a higher monthly pension. Effective from late January, the January 2026 increase reflects growing awareness of senior living costs that have steadily climbed over recent years. Food, transport, and healthcare remain the biggest pressures for pensioners, especially those supporting extended families. By lifting payments up to R2,400, the state is making a visible government support shift toward protecting older citizens from financial stress while maintaining consistency in monthly disbursements.

Old age pension eligibility rules and income limits explained

While payment amounts are rising, access to the grant still depends on clear criteria. Authorities have reaffirmed revised eligibility rules to ensure support reaches those who need it most. This includes stricter income threshold checks and a regular asset limit review to prevent misuse of funds. Seniors already receiving the grant are encouraged to keep their records updated, as application updates and periodic verification may affect continued payments. Understanding these conditions can help beneficiaries avoid delays or unexpected suspensions.

Old age pension payment dates and payout methods for seniors

Alongside higher amounts, officials are prioritising smoother delivery. Clear communication around payment date clarity helps seniors plan their monthly budgets with confidence. Beneficiaries can still choose between several banking method options, including direct deposits and approved cards, while rural recipients may rely on grant collection points. To reduce fraud and errors, new digital verification steps are being phased in, making it important for seniors to follow official notices and instructions carefully.

What the pension increase means for seniors going forward

This pension adjustment offers more than just a higher figure on paper. For many households, it represents long term relief from constant financial strain and reinforces dignity in ageing. With a more predictable income, seniors can approach essentials and healthcare with greater assurance, building financial planning confidence in uncertain times. While challenges remain, the strengthened social safety net shows a commitment to protecting older citizens as economic conditions continue to evolve.

| Category | Details |

|---|---|

| Maximum monthly amount | Up to R2,400 |

| Effective date | 25 January 2026 |

| Age requirement | 60 years and older |

| Payment methods | Bank deposit, card, pay points |

| Key condition | Means test applies |

Frequently Asked Questions (FAQs)

1. Who qualifies for the increased old age pension?

Seniors aged 60 or older who meet the income and asset limits qualify.

2. When do the new pension payments start?

The higher payments apply from 25 January 2026.

3. Do current beneficiaries need to reapply?

No, but they must keep personal and financial information updated.

4. How will seniors receive the pension each month?

Payments are made via bank accounts, grant cards, or approved pay points.