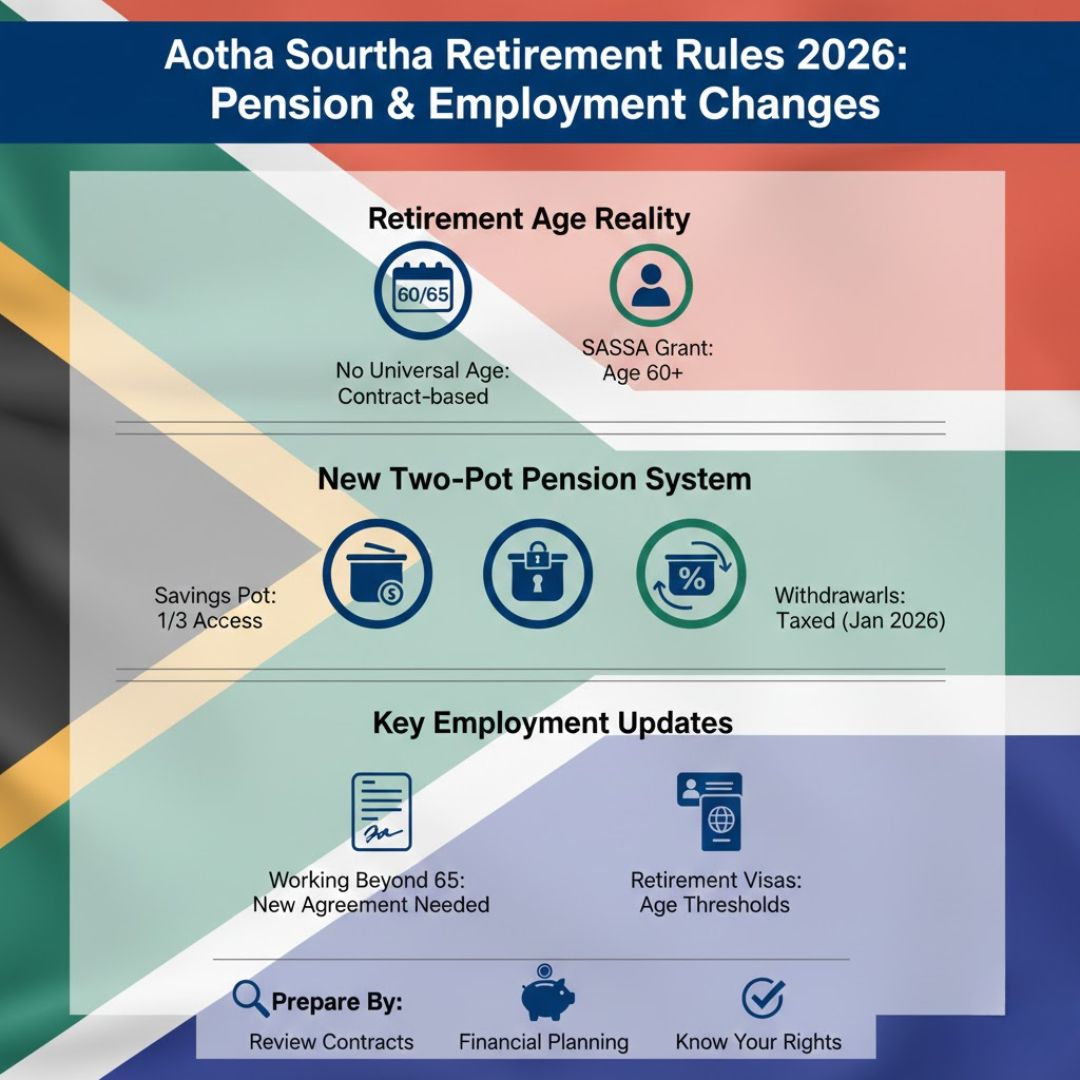

South Africa is entering a new phase in its retirement landscape as the long-standing age threshold of 65 gives way to revised rules starting January. This retirement age shift is reshaping how workers plan their exit from employment and how pensions are accessed across the country. The policy change reflects economic pressures, longer life expectancy, and the need to balance public finances with social protection. For employees, employers, and pensioners alike, the transition introduces new timelines, compliance expectations, and planning decisions that will influence financial security well into later life.

South Africa retirement age shift and new pension timelines

The South Africa retirement age shift adjusts when individuals can formally retire and claim pension benefits, altering decades of established practice. Workers approaching retirement now face recalibrated timelines that encourage longer participation in the workforce while protecting income stability. Authorities argue this approach strengthens sustainability by spreading pension costs over more working years. For many households, understanding revised retirement thresholds, adjusted pension access, and updated contribution periods is essential to avoid gaps in income. Financial advisers are urging individuals to review plans early, as transition rules and age-based eligibility may differ depending on employment sector, fund type, and years of service.

Employment rules under South Africa’s retirement age changes

Beyond pensions, the retirement age changes in South Africa also influence workplace policies and contracts. Employers are being guided to align human resource frameworks with the new age limits, particularly around contract renewals and phased exits. Employees may see opportunities for extended careers, flexible arrangements, or gradual retirement options. Key considerations include extended working years, contractual adjustments, workplace compliance, and labour law alignment. While some welcome the chance to earn longer, others worry about job mobility for younger workers, making intergenerational balance a central part of the debate.

Goodbye to Retirement at 67 as South Africa Revises Pension and Retirement Age Rules Starting 2026

Goodbye to Retirement at 67 as South Africa Revises Pension and Retirement Age Rules Starting 2026

Pension planning after South Africa retirement age reform

Effective pension planning is now more important than ever following South Africa’s retirement age reform. Individuals must reassess savings targets, risk tolerance, and expected retirement dates to match the new framework. Delaying retirement can increase total benefits, but it also requires careful health and lifestyle planning. Experts recommend focusing on long-term savings strategy, income sustainability, benefit optimisation, and personal financial reviews. Those nearing retirement should also factor in inflation resilience to ensure that extended working years translate into genuine financial security rather than prolonged uncertainty.

What the retirement age shift means overall

Overall, the retirement age shift signals a structural recalibration rather than a simple policy tweak. It reflects changing demographics, fiscal realities, and evolving expectations about working life in South Africa. While the changes may feel disruptive at first, they are designed to create a more durable pension system over time. Success will depend on clear communication, supportive employer practices, and informed individual choices. By focusing on system sustainability, financial preparedness, policy clarity, and shared responsibility, the transition has the potential to strengthen retirement outcomes for future generations.

| Category | Previous Rule | New Rule (January) |

|---|---|---|

| Standard Retirement Age | 65 years | Revised threshold |

| Pension Access | Immediate at 65 | Linked to new age |

| Employment Duration | Fixed exit point | Extended options |

| Planning Requirement | Minimal review | Early reassessment |

Frequently Asked Questions (FAQs)

1. When does the new retirement age take effect?

The updated retirement age rules apply from January under the new policy.

2. Does everyone have to work longer?

No, options vary by sector, contract terms, and individual pension arrangements.

3. Will pension amounts change?

Benefits may increase with longer contributions, depending on the pension fund.

4. Should individuals review their retirement plans now?

Yes, early review helps align savings and timelines with the new rules.